As 2022 is underway, I’d like to detail a few market cross-currents that will likely have influence over the course of the year.

A few of these factors include the inflation dynamic, consumer spending, corporate profit margins, and Fed Policy.

With the recent Consumer Price Index print of 7% YOY, it’s fair to say the Fed has underestimated inflation, relative to their transitory stance throughout 2021. Therefore, it’s right for the Fed to take a more hawkish monetary policy stance, however, what they say and what they do remain the critical question as 2022 unfolds. Granted, the environment in 2022 is different than 2019, but leading up to that year, both GS and JPM were predicting 4 rate hikes, similar to current. The Fed actually ended up cutting 3 times in 2019. Now, I’m not suggesting rate cuts are in the cards, but we are entering a somewhat slower growth environment, so they’ll unlikely be too hawkish while the Pandemic-influenced components of inflation likely cool off.

We should also be reminded of the Fed’s shift in policy in 2021 that went from focus on Forward Expectations to Data Dependency. This allows for some level of patience that a portion of their transitory inflation narrative still plays out, and the data should bear this out, as it appears to perhaps already be doing.

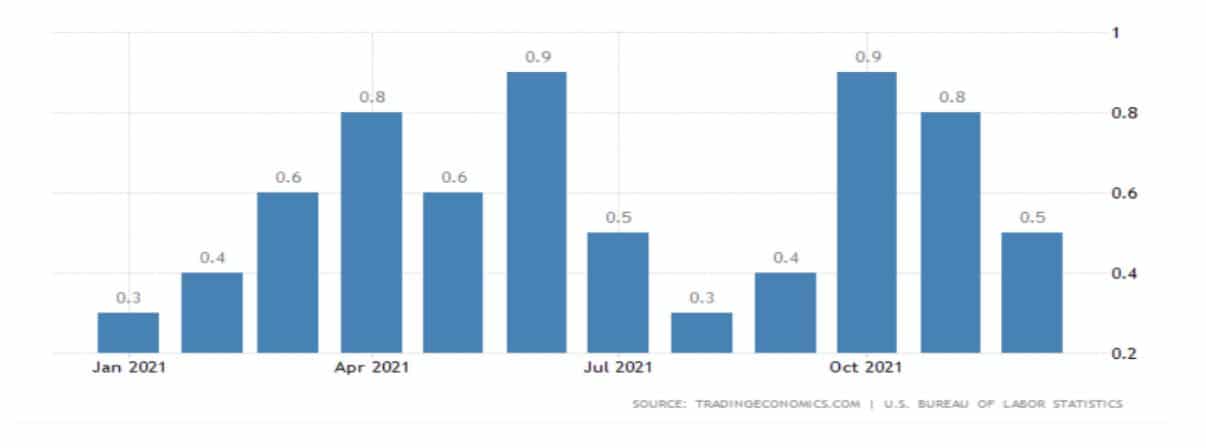

As seen in the chart below, the month over month CPI readings, have been declining since a peak in October:

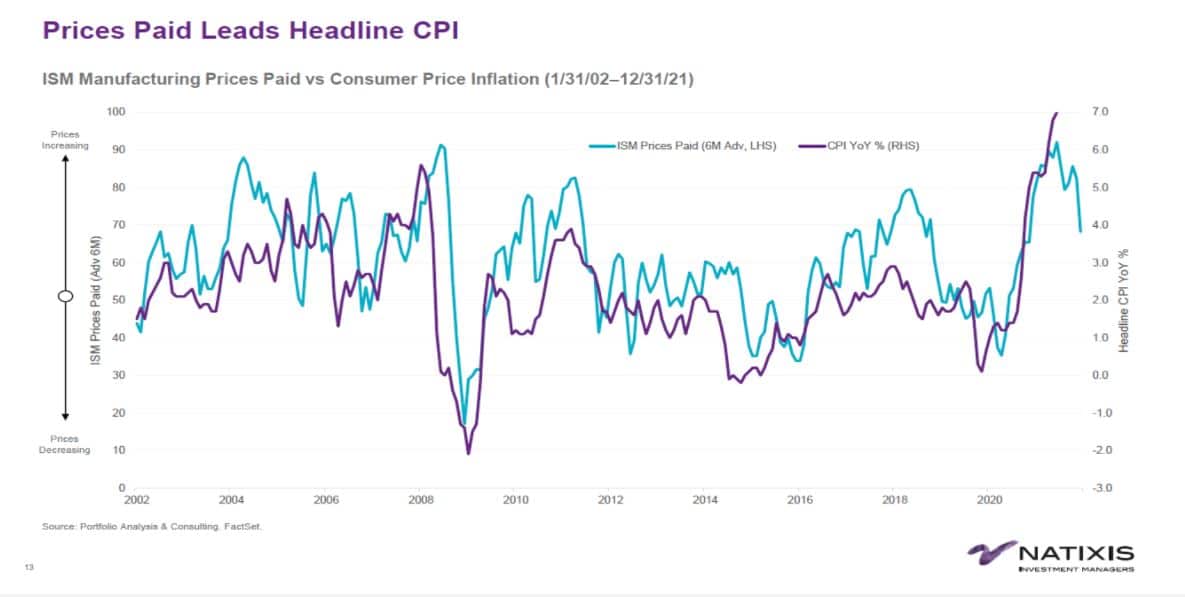

In addition, historical data from Natixis, shows us that a decline in the ISM Manufacturing prices paid index has historically lead to a decline in the CPI Index, and it’s recently declined meaningfully.

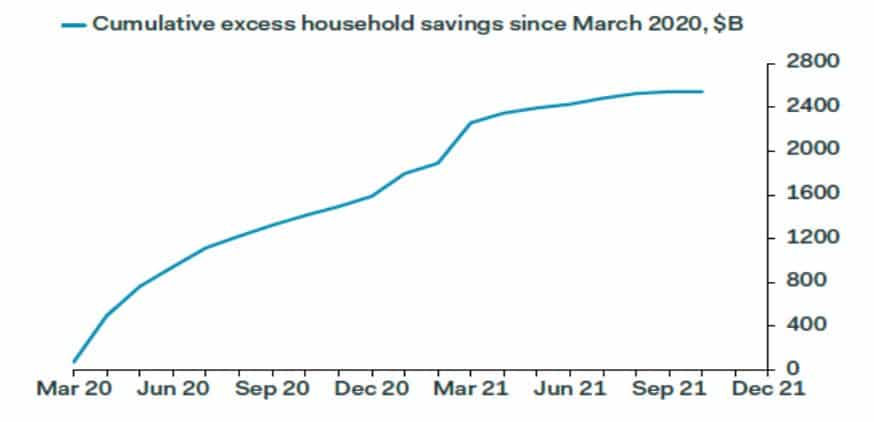

If we shift focus to the health of the consumer and corporations, I’d like to point out that not only are we coming off historic household savings balances, which can help support future consumption, as seen in the following chart…

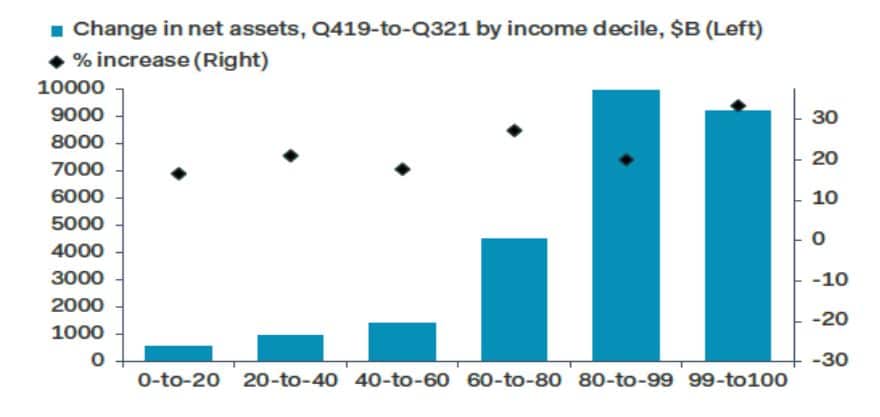

…but Americans across each income decile have experienced a meaningful increase in net assets relative to the end of 2019, as seen in this next chart from Pantheon Economics:

From the corporate view, profit margins were close to a record 13% in 2021 and while they’ll likely decline, it allows the ability to withstand some level of rising input costs and wage pressures, which should abate, in part, over time.

Bottom line is that we appear to be embarking on a new monetary policy regime not seen in some-time after 12 years of varying degrees of accommodation. However, GDP growth, driven by a healthy consumer, and ultimately earnings, still should be above trend. To this end, according to Refinitiv, earnings are projected to have been up by over 22% for Q4 2021 and up over 49% for 2021. They had also been rising throughout the course of the year. 2022 earnings growth should likely be more in-line with long-term averages of mid to high single-digits, which should help support equity markets, albeit with likely more historically normal price volatility than we’ve seen over the last year as many of the discussed cross-currents swirl.

So I’ll leave you with this: Will the Fed aggressively shift monetary policy into a slowing economy to combat inflationary pressures? It appears they’ll have to in some capacity, but to what extent, remains an important question. I actually think they’ll end up being more right in that there will be normalization from supply chains/Covid-related issues and an artificially high spend on goods…it will just take longer.