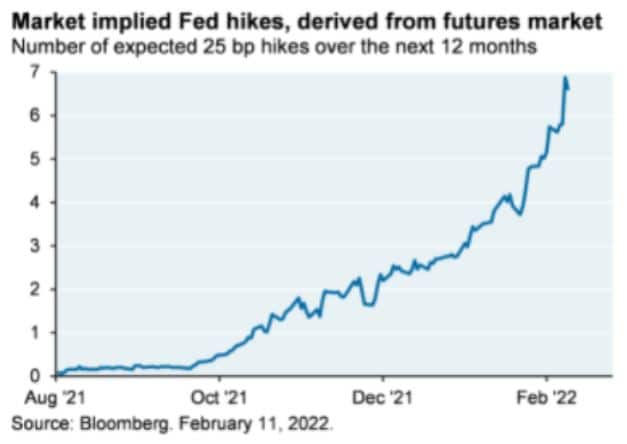

Good afternoon, with minimal financial market volatility in 2021, it’s evident the pendulum has swung in the opposite direction here in early 2022. I’d like to zoom out and paint the picture as to why things aren’t as bad as perhaps perceived and to help explain some possible causes of this market turbulence. This first chart is a view of market implied rate hikes from JPM courtesy of Bloomberg data. In looking at this chart, you can appreciate the magnitude in the shift around rate hike expectations from just a few months ago. As recent as September, there weren’t expectations for even one rate hike in 2022 and now the market is pricing in 7, as BAC, GS, and now JPM are all singing harmoniously with this call. This sure is a lot for the market to digest in what is a complete change in policy expectations. Is it any wonder, we opened the year with over a 10% correction in the S&P 500 and even greater declines exceeding 15% for the Nasdaq and Russell 2000 small cap index? I believe if the Fed were truly worried about inflation not settling down, at least in part, then an abrupt ending to emergency era monetary policy would have already ceased, yet balance sheet expansion continues into March.

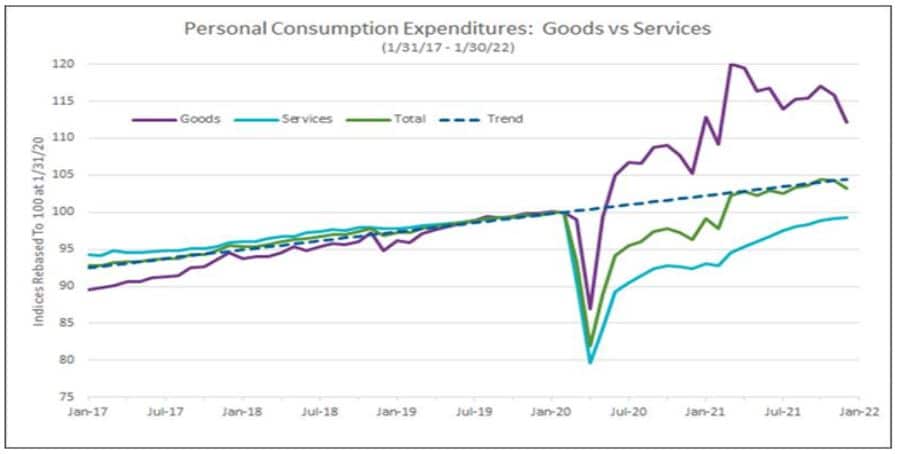

Ironically, Minneapolis Fed President Kashkari indicated just a few days ago that we should be well on our way back to 2% inflation by year-end. Now, I’m not sure I buy into this view either. Quite a disconnect from the 7.5% YOY CPI print from a week ago. I’m suggesting, perhaps like many things, the truth or reality, is probably somewhere in the middle, as 7 rate hikes and 2% range inflation by year-end don’t quite square up. To be clear, the Fed has navigated through an extremely difficult environment and has been charged with a tough task in a very abnormal environment, so let’s look at one such distortion. In the purple line on the chart below from Natixis, you’ll notice just how far above historical trend that goods consumption has been over the last 2 years and how it’s begun to roll over. This normalization between goods and services consumption should help partially dampen the inflationary pressures related to an extraordinary consumption of goods and the pressures that have been put on many systems tied to inflation, as a result.

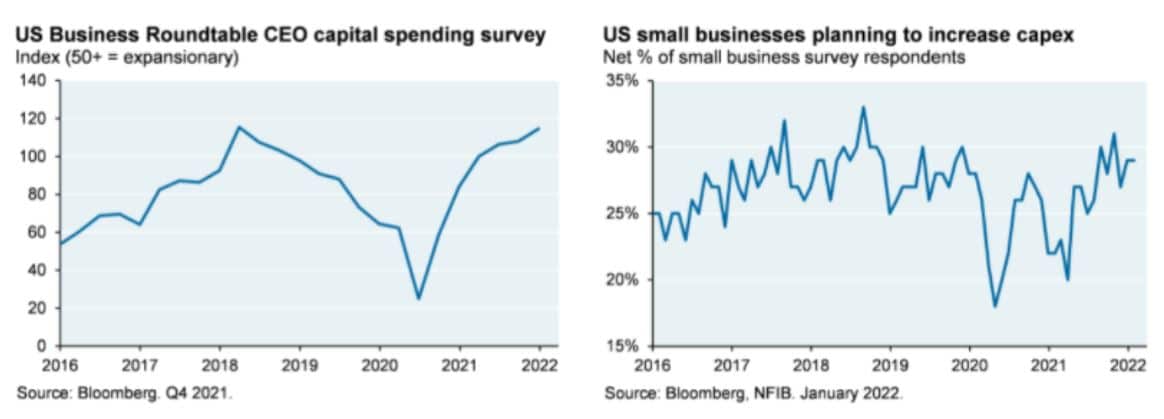

In addressing the pessimistic mood that’s been brought on by inflation here in early 2022, it’s important to not lose sight of reasons for optimism amidst a lot of noise. Earnings growth for the quarters beyond a dampened Q1, have been adjusting upward over the last few months at a more normalized long-term trend rate. Both corporations and consumers are generally both financially healthy and we just experienced a very strong January retail sales number. The market has had a healthy reset, especially in the frothier market segments, such as non-profitable tech, as an example. In fact, over 50% of the S&P 500 companies have sold off 20% or more from their highs. This number is approaching an astounding 80% of companies in the Nasdaq. We’re also starting to see some green shoots leading to the easing of inflationary pressures in some areas including supply chain pressures during a normalizing shift from goods to services consumption. Additionally, inventories are getting replenished and are companies are looking to spend as can be seen on this chart from JPM, which bodes well for the economy going forward.

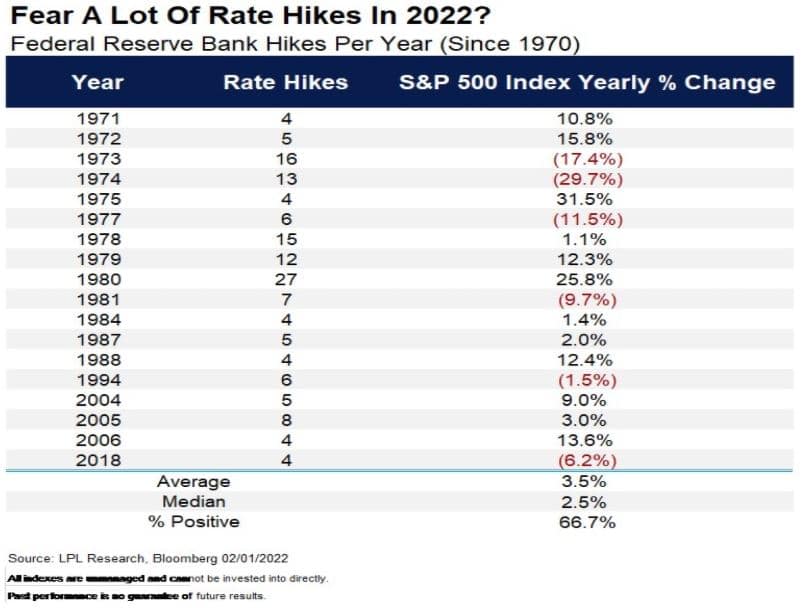

And last but not least, we’re finally reaching the eventuality of the first rate-hike in years, and history shows that taking the long view wins out the majority of the time, as shown in this chart from LPL Research and Bloomberg: In most instances historically, stocks are higher 6 to 12 months after the first hike.

And for those worried about a series of rate hikes this year, history shows, that’s also not reason to fret, as we’ve seen this many times before: This chart, also from LPL Research, shows prior rate hike cycles and stock market performance in the year in which there were a number of hikes. You’ll notice that both the average and median market performance in years with a number of hikes, has been positive.

So what should we be concluding at this point? I’ll leave you with 3 things. 1) The market has had to digest a lot with such a dramatic policy shift due to stronger than anticipated inflation, so a corrective move in the market is both overdue and healthy 2) History shows there is market anxiety around meaningful policy change periods, such as first rate hikes, but taking a multi-year view tends to pay-off 3) Inflation is a lagging indicator and we’re beginning to see some signs of inflationary pressures beginning to ease in portions of the economy. The question now becomes how quickly does it fall and to what level. As Liz Ann Sonders of Charles Schwab often says, it’s not good or bad that tends to matter, but better or worse, and we’re expecting the inflationary picture to get better as we work through 2022.