Saving for education expenses is a priority for many families, and 529 plans can be valuable tools in achieving this goal. A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs; primarily intended for higher education expenses, these plans can also be used for K-12 tuition costs in most states. The funds in a 529 plan are contributed on behalf of the beneficiary and then invested to allow tax-deferred growth, meaning that taxes on earnings are deferred while they are in the account; additionally, withdrawals are tax-free when used for qualified education expenses. As many states also offer deductions or credits for 529 contributions, these plans have become powerful savings vehicles for educational expenses.

One potential pitfall of 529 plans is that non-qualified distributions are subject to income tax, plus a 10% withdrawal penalty, on the earnings portion of the distribution. This drawback often leads to worrying about saving “too much” for education – what can be done with the leftover 529 funds?

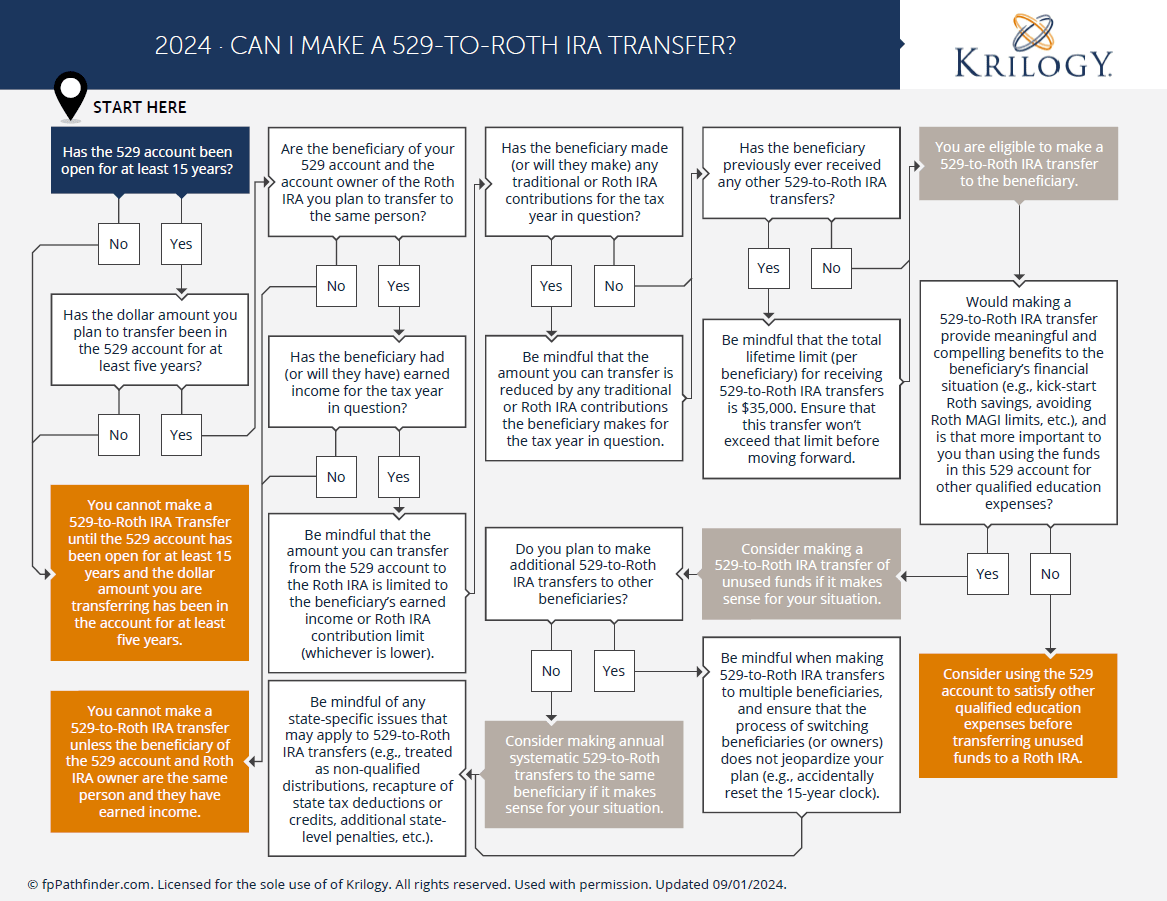

The SECURE 2.0 Act includes a provision which took effect on January 1, 2024, allowing unused 529 plan funds to be rolled over into the beneficiary’s Roth IRA. This transfer avoids the typical 10% penalty for nonqualified withdrawals and does not generate taxable income. This could provide reassurance for those concerned about having leftover funds in a 529 plan if the intended beneficiary does not use them.

While this provision may seem very appealing at first glance, it’s important to note that there are a few limitations and requirements for this type of rollover:

- The 529 plan must be owned for at least 15 years before a rollover can be initiated.

- Only contributions made at least five years prior to distribution, along with associated earnings, qualify for tax-free rollovers.

- The beneficiary of the 529 plan must be the beneficiary of the Roth IRA.

- Each rollover amount cannot exceed the annual Roth IRA contribution limit for that year, minus any direct contributions made by the taxpayer to the IRA during that period.

- The beneficiary must have earned income equal to at least the amount rolled over into the Roth IRA.

- The lifetime limit for a beneficiary to rollover is $35,000.

It’s crucial to exercise caution, as future guidance by the IRS regarding these rules may change or clarify the interpretation of the SECURE 2.0 Act legislation. For personalized advice tailored to your financial situation, consider consulting with your Krilogy advisor.

This information is distributed for educational purposes only, and it is not to be construed as an offer, solicitation, recommendation, or endorsement. Krilogy® does not provide tax and legal advice. Krilogy® is affiliated with Krilogy Tax Services, LLC. Krilogy® Tax Services provides tax planning and preparation services for an additional cost to Krilogy® clients. You should consult your attorney or qualified tax advisor regarding your situation.’ With this disclosure added, this has been reviewed and is approved from a compliance perspective.

Important Disclosures:

Investment Advisory Services offered through Krilogy Financial® (“Krilogy”), an SEC Registered Investment Advisor. Please review Krilogy’s Client Relationship Summary (“CRS”) and Form ADV 2A (“Firm Brochure”) carefully prior to investing. All expressions of opinion are subject to change. This information is distributed for educational purposes only, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services, nor is it to be construed as individualized advice or recommendations suitable for the reader.

Diversification does not eliminate the risk of market loss. Investments involve risk and unless otherwise stated, are not guaranteed. Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. Investment risks include loss of principal and fluctuating value. There is no guarantee an investing strategy will be successful. Past performance is not a guarantee of future results. Krilogy, its employees and financial advisors do not provide tax and legal advice. Krilogy provides investment management and financial planning advice. This advice may indirectly impact certain tax and legal advice received from your tax and legal professionals. You should consult your attorney or qualified tax advisor regarding your situation. Krilogy Tax Services, LLC is an affiliated company to Krilogy and provides tax services under separate engagement for a fee. KEP Law, LLC d/b/a Krilogy Law is an independent law firm that provides estate and business planning under separate engagement for a fee. Krilogy and KEP Law, LLC have common owners. All information contained herein should be independently verified and confirmed.