Market Resiliency Leads to Solid Market Gains in Q1

We’ve often said that we believe in resiliency of the U.S., our economy, and the markets. The first quarter of 2021 was a shining example of why we hold this belief.

Throughout the quarter, we witnessed several macro- and micro-economic surprises that resulted in increased market volatility compared to the fourth quarter of 2020. These surprises, however, were met with additional economic stimulus, accelerated COVID-19 vaccine distribution and a decline in coronavirus cases. These factors combined to create the balance needed for stocks to start the new year with solid gains.

The first surprise of 2021 came on January 5th, the day of the Georgia Senatorial runoff election for both seats in the United States Senate. That election resulted in victory for both Democratic candidates, giving the Democratic party a majority in the Senate, and control of Congress and the presidency.

The next day, during confirmation of the November 2020 presidential election results, protestors stormed the U.S. Capitol, causing a temporary delay to the election certification and marking a historically tragic day in the U.S. democratic process. After that delay, Joe Biden was certified as the winner of the 2020 election and became president-elect of the United States. Both the surprise election results and the incident at the Capitol caused a volatile start to the new year.

In late January, after two weeks of relative calm, market volatility returned, this time driven by a historic short squeeze in videogame retailer GameStop (GME). The disorderly trading in GameStop and select other stocks caused broader market volatility, driven primarily by fears of losses inflicted on large hedge funds. Those factors pressured stocks and the S&P 500 finished January with a modest loss.

Concerns of widespread losses due to GameStop trading ultimately proved unfounded, and the volatility linked to the GameStop saga dissipated in early February. As trading returned to normal, investors began to focus on macro-economic positives.

First, the Democratic-controlled government immediately began steps to pass another significant economic stimulus bill, which helped stocks rally in early February. Second, vaccine distribution throughout the U.S. meaningfully accelerated in February. Increased distribution combined with the authorization of a single-dose Johnson & Johnson COVID-19 vaccine helped investors embrace the idea that the end of the pandemic was now possibly just months away, a sentiment which helped stocks rally further. Finally, COVID-19 cases began to decline rapidly in the U.S., leading to economic re-openings in several states. The S&P 500 recouped all of January’s losses and ended February slightly positive for the year.

Markets continued to rally in early March as investors began to price in a looming economic recovery following the passage of the $1.9 trillion economic stimulus bill, which President Biden signed on March 11th. The new stimulus, combined with COVID-19 vaccine distribution reaching 2.5 million doses per day, resulted in growing expectations for a full economic reopening and recovery in the coming months.

Expectations for an acceleration in economic growth also pushed Treasury yields higher during the month of March. The 10-year Treasury yield surged to fresh one-year highs. The rapid rise in bond yields weighed on stocks periodically throughout March, as higher borrowing costs could become a future headwind on economic growth. The risk of high yields must be monitored going forward, but this factor alone was not enough to offset the reality of historic economic stimulus and improvement in the pandemic. As a result, stocks drifted higher to finish the quarter with solid gains.

The first quarter of 2021 reminded investors of the volatility and unpredictable nature of markets that we witnessed in 2020. However, just as markets proved resilient last year, stocks overcame multiple surprises during the first quarter to provide another positive quarterly return.

1st Quarter Performance Review

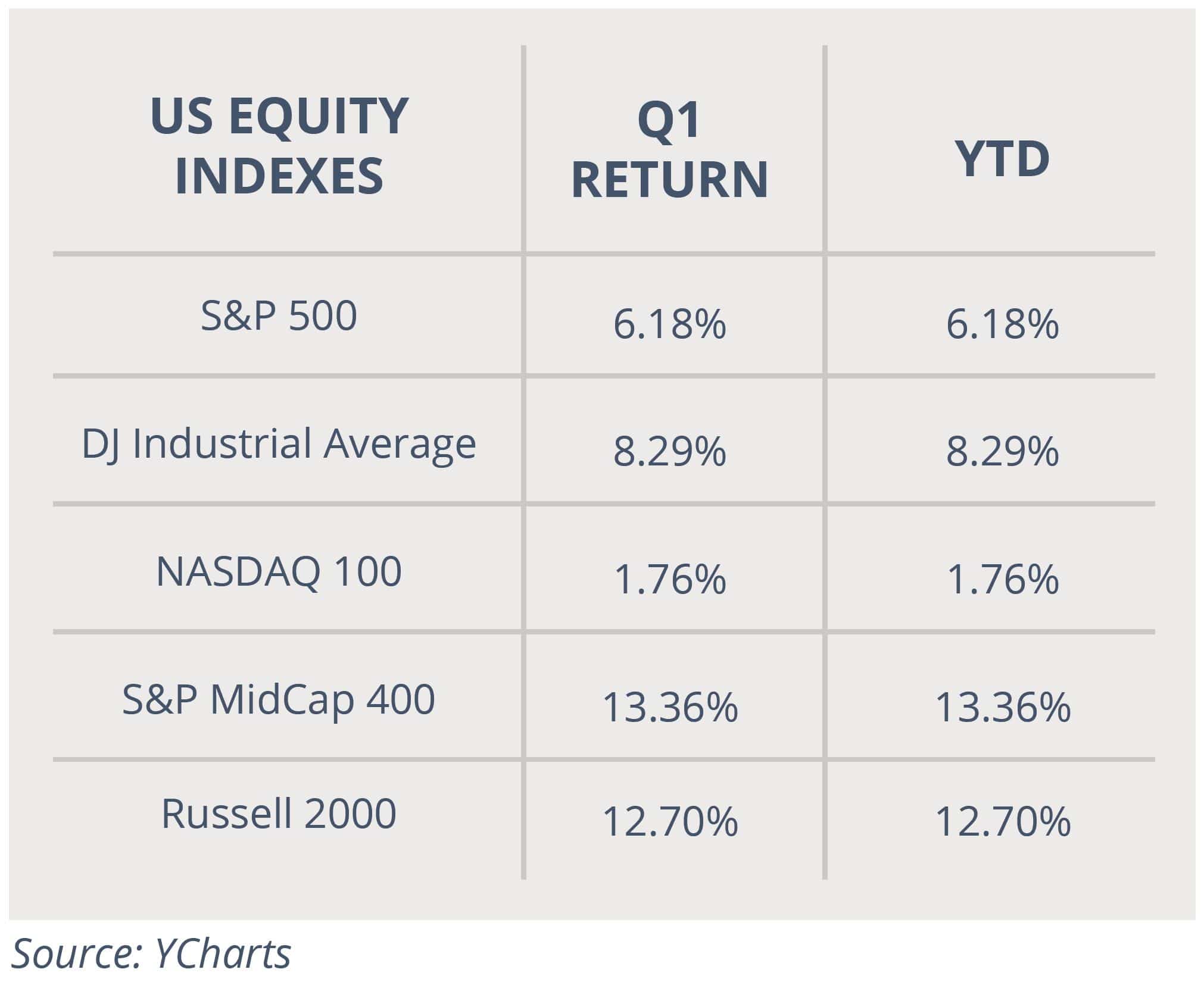

Expectations of a post-COVID-19 economic recovery drove market performance in the first quarter. The Dow Jones Industrial Average outperformed both the S&P 500 and the Nasdaq 100 due to the underperformance of technology shares.

By market capitalization, small-cap stocks, which are historically more sensitive to changes in economic growth, outperformed large-cap stocks as COVID-19 cases declined and numerous states partially or fully reopened their economies. This led investors to expect a broad acceleration in future economic activity.

From an investment style standpoint, value handily outperformed growth for a second consecutive quarter. The substantial outperformance by value stocks once again underscored increasing investor optimism for an economic rebound in the coming months.

On a sector level, all 11 S&P 500 sectors finished the first quarter with positive returns. Cyclical sectors, including energy, financials, industrials, and materials led markets higher for the second straight quarter. As mentioned, expectations of an acceleration in future economic growth (again, mainly a product of stimulus and COVID-19 vaccine distribution), combined with higher bond yields and fears of potentially rising inflation, drove the cyclical sector outperformance in the first quarter.

One of the biggest sector laggards in the first quarter was tech. Investors rotated out of tech stocks and into cyclical sectors as they positioned for an acceleration of economic activity that is expected to accompany a full economic reopening. Traditionally defensive sectors such as utilities, health care, and consumer staples also underperformed the S&P 500 on the expectations of a strong economic rebound.

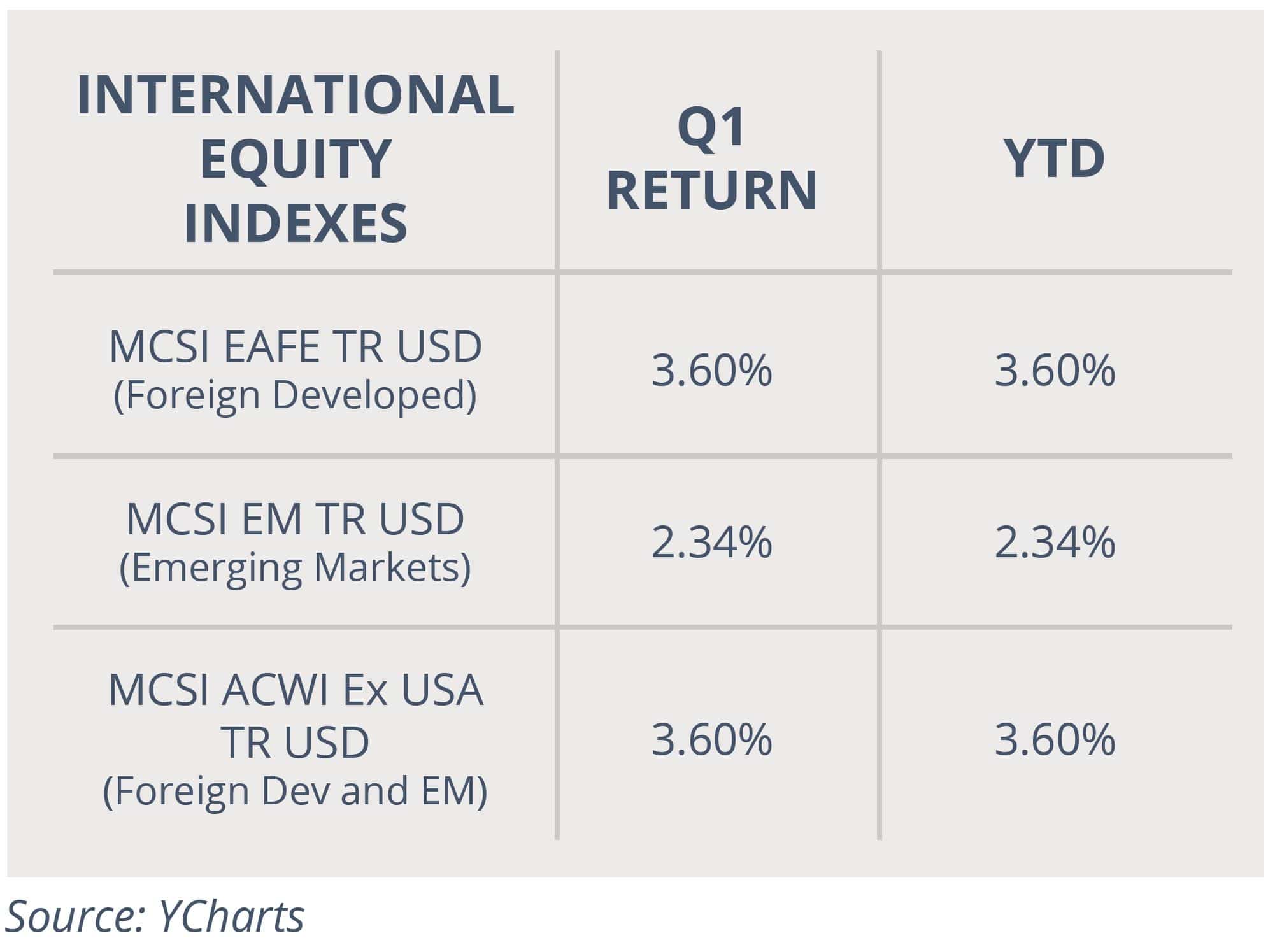

Internationally, foreign markets saw positive returns in the first quarter thanks to declining COVID-19 cases, continued progress on vaccinations, and initial signs of an economic reopening across the EU and UK. Emerging markets also rallied in the first quarter on hopes of a global economic recovery, although they underperformed foreign developed markets. This underperformance was largely due to headwinds from a stronger U.S. dollar and economic turmoil in Turkey following the firing of the head of the Turkish central bank. Both foreign developed and emerging markets underperformed the S&P 500 in the first quarter.

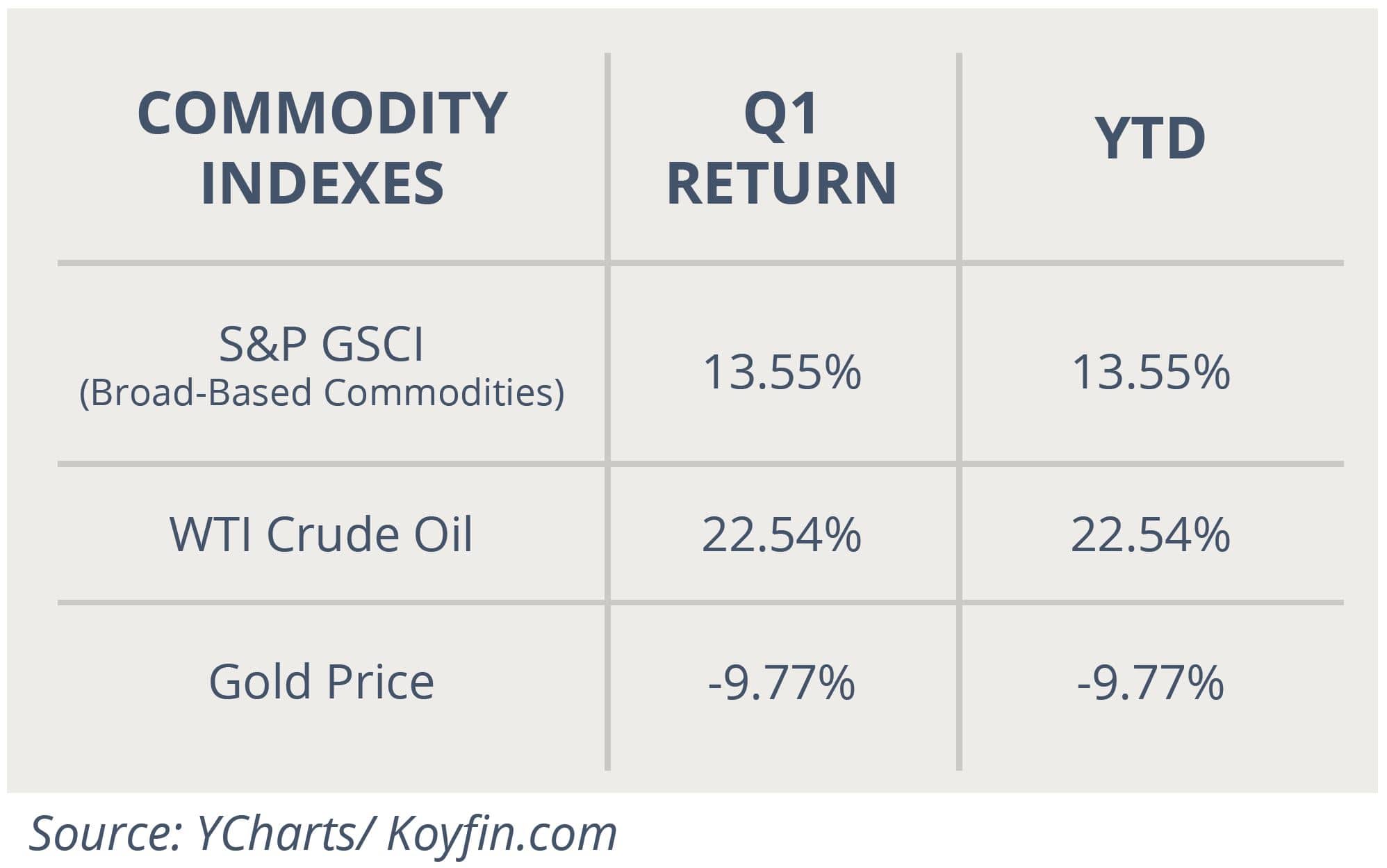

Commodities posted strong gains for the second consecutive quarter and notably outperformed the S&P 500 over the past three months. Major commodity indices were led higher by a large rally in crude oil futures as investors anticipated an increase in demand for both oil and refined products as the global economy begins to normalize. Gold, however, posted another quarterly decline despite rising fears of higher inflation. A stronger U.S. dollar combined with the increasing popularity of alternative investments such as Bitcoin dampened demand for the precious metal.

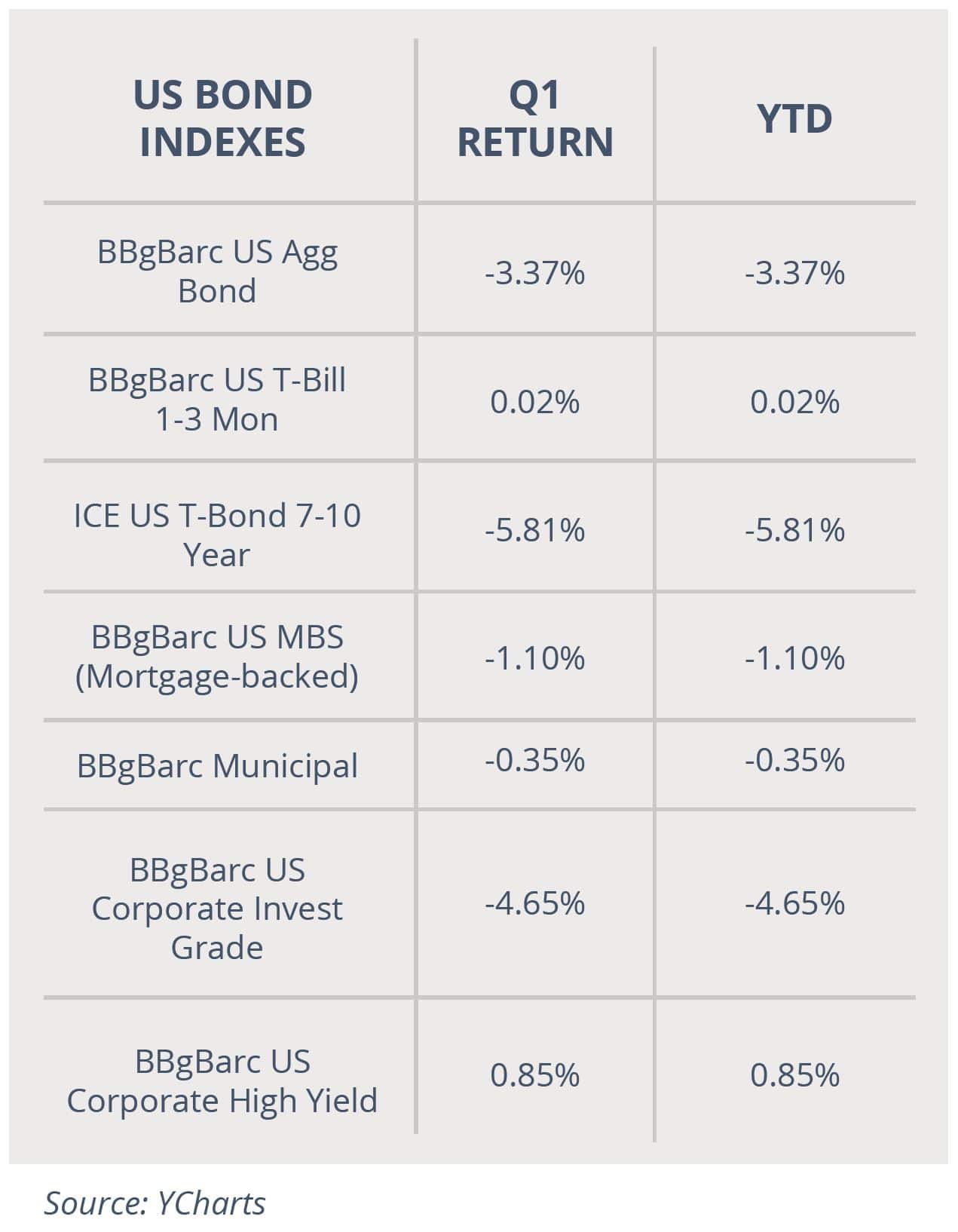

Switching to fixed income markets, quarterly total returns for most bond classes were negative for the first time in more than two years. Large economic stimulus packages combined with COVID-19 vaccinations led to an acceleration in economic growth expectations in the coming months. This, however, also resulted in a surge in inflation estimates, which topped a five-year high in the first quarter and weighed broadly on the fixed income markets.

Looking deeper into the bond markets, longer-duration bonds underperformed those with shorter durations in the first quarter. That substantial underperformance was driven by the Fed’s consistent promise to keep short-duration interest rates unchanged while the market priced in higher future levels of inflation. This, in turn, pressured bonds with longer-dated maturities.

In the corporate debt markets, lower quality but higher yielding bonds handily outperformed investment grade bonds. This further confirms that during the first quarter of 2021 investors were positioning for a broad economic rebound later in the year. Investment grade corporate bonds underperformed as investors embraced more risk in their fixed income portfolios and as the decline in longer-dated Treasury bonds weighed on higher quality debt.

2nd Quarter Market Outlook

The outlook for markets remains broadly positive moving into second quarter. Monies from the recently passed stimulus bill are now entering the economy on a personal, corporate and government level. Those funds should help to spur economic growth in the months ahead.

Additionally, while the COVID-19 outlook has recently dimmed in Europe, the outlook for the U.S. remains generally positive. Vaccine distribution continues to accelerate, with the goal of having vaccines available to all adults nationwide by May. It is not unreasonable to think the pandemic will be declared “over” by the early summer. COVID-19 inflections will continue, just not at a pandemic level that requires a large-scale government response.

Meanwhile, the outlook for the economic recovery remains bright, with improvement across multiple economic indicators. The Federal Reserve has pledged numerous times their intent to keep interest rates low and retain its quantitative easing (QE) program until the economy returns to pre-pandemic activity levels.

Those factors all provide substantial support for markets as we begin the second quarter.

The first quarter clearly demonstrated there are always risks to be monitored. First, rising bond yields caused volatility in late February and throughout March. If the pace of the rise in bond yields accelerates, we can expect more stock and bond market volatility as high interest rates are a threat to the economic recovery.

Similarly, investors are expecting inflation to accelerate as stimulus fuels the economic recovery. Federal Reserve officials currently expect any increase in inflation to be temporary. If that expectation proves to be incorrect, the Fed will have to remove stimulus via a reduction in the current QE program, which is not priced into markets right now.

Regarding the pandemic, the trend in the U.S. is clearly positive. Parts of Europe, however, are struggling with vaccine supply, and there is always the risk of a broader vaccine supply disruption or of a new COVID-19 strain that renders vaccines less effective. Any of those events would pose a threat to the rally in the stock market.

From a fiscal standpoint, the multiple rounds of stimulus have resulted in very large increases to the national debt and federal deficits. The recently passed stimulus bill exacerbated those existing issues. So far, markets haven’t seen any negative impacts related to the growing debt or deficits. These high levels of debt and deficits represent longer-term risks to U.S. financial stability, and it remains unclear when those risks will begin to impact asset prices.

Finally, 2021 markets have embraced the Democratic agenda of more economic stimulus. Numerous prominent Democrats, meanwhile, also are in favor of increased corporate, personal and investment taxes. If those efforts gain momentum, we can expect increased market volatility.

These potential risks currently do not outweigh the actual positive influences pushing stocks higher. The macroeconomic outlook for the second quarter remains positive. We will be monitoring all of the risks listed above as well as any others that pose threats to your investments.

The start of 2021 showed that even though 2020 is behind us and the pandemic is likely closer to the end than the beginning, volatility and macro-economic surprises will remain with us. We should all remain prepared for continued volatility.

Importantly, though, the experiences of the first quarter clearly demonstrated that a well-executed, diversified, long-term, focused financial plan can overcome temporary bouts of volatility, just like it did in 2020.

At Krilogy, we understand the risks facing both the markets and the economy, and we are committed to helping you effectively navigate this still-challenging investment environment. Successful investing is a marathon, not a sprint. Even intense volatility is unlikely to alter a diversified approach set up to meet your long-term investment goals.

It is critical for you to stay invested, remain patient, and stick to the plan we’ve established together, which is based on your unique, personal allocation target, your financial position, risk tolerance, and investment timeline.

The resilient nature of markets in 2021 notwithstanding, we remain vigilant towards risks to portfolios and the economy. We thank you for your ongoing confidence and trust. Please rest assured that our entire team will remain dedicated to helping you successfully navigate this market environment.

Important Disclosures

Information contained in this document is provided by an independent third party, Ned Davis Research. While believed to be accurate, Krilogy has not independently confirmed each piece of information.

Investment Advisory Services offered through Krilogy®, an SEC Registered Investment Advisor. Please review Krilogy’s Form ADV 2A carefully prior to investing.

All expressions of opinion are subject to change. This information is distributed for educational purposes only. It should not be construed as individualized advice or recommendations suitable for the reader.

Diversification does not eliminate the risk of market loss. Investments involve risk and unless otherwise stated, are not guaranteed. Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. Investment risks include loss of principal and fluctuating value. There is no guarantee an investing strategy will be successful. Past performance is not a guarantee of future results.