Missing Any One of the Ten Best Days!

Let’s define “timing the market” as temporarily moving a large portion of equity investments into cash (or fixed income) with the intent of moving back to equities at a time of greater perceived stability. Selling out of the market is typically a cautionary reaction to an expected market decline, or worse, a defensive reaction after a market decline.

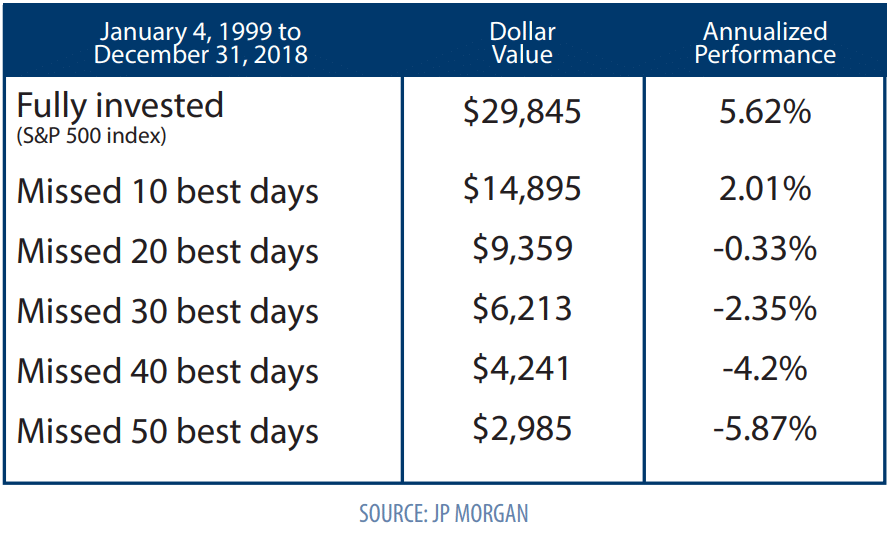

One significant risk of moving out of the market is missing strong market performance concentrated in just a few days or even one day. The data have shown that a significant amount of market growth comes in very few days. Missing the 10 best days over a 20-year period can reduce the overall return by more than half. That’s right, by one measure, more growth came from just 10 days spread throughout a 20-year period than in all the other 7,290 days combined during the same time period.

The following chart illustrates that impact of missing the best 10, 20, 30, 40, and 50 days in the market over the last 20 years of investment in the S&P 500 (the 500 largest companies in the US). Without the best 10 days, an investment in the S&P 500 that otherwise would have returned 5.62% per year, returned only 2.01% per year. This difference demonstrates how critical it is to stay invested in the market every day of the year, even (or perhaps especially) during times of greatest volatility.

If investors try to protect themselves against market declines by moving money in and out of the market, they will have to time it right twice. They have to sell out of the market before the decline, and then they also have to reinvest when the market is at its lowest. The likelihood that an investor will get back into the market to benefit from those few critical days of strong performance is low.

So how can we protect ourselves from declines in the market while still keeping the portfolio fully invested?

- Investors should have an asset allocation (a balance of equities and fixed income) that properly accounts for their ability and willingness to take risk.

- The fixed income portion of the portfolio should be comprised largely of short- to medium-term, high quality fixed income. High quality fixed income is less likely than low quality fixed income to decline with equities in a market downturn.

- The equity portion of the portfolio should be diversified across company size and company style and across different countries. Such robust diversification will lower overall volatility.

Market timing can be tempting to some people, but the results can also be quite damaging. As always, we believe the best foundation for your future is a well-crafted plan focused on your financial objectives and your personal goals. In this case, we are reminded of the importance of sticking with that plan.