Good afternoon, instead of contemplating how persistent and enduring inflationary pressures in the economy are or aren’t, I thought I’d provide some perspective on what above average and high inflationary periods have meant for equities historically. Separate from the inflation conversation and what it could mean for equities, I think it’s important to level-set expectations for expected returns in traditional capital markets exposure in equities and fixed income, broadly speaking. As a result of low interest rates, slower longer-term economic growth, and generally higher valuations, among other factors, both are likely to be a fraction of what we’ve experienced that last 10 plus years. Exposures within equities and fixed income are certainly not all created equal and focus on expected returns within these two broad categories, along with exploration of different sources of return within other strategies, including private markets, can certainly be prudent in the current environment.

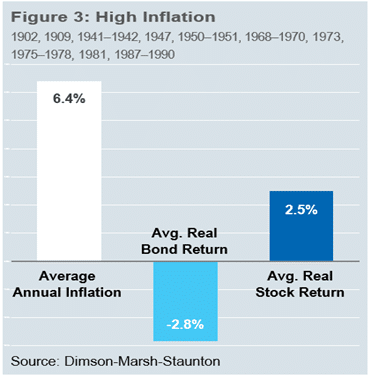

With respect to equities in various historical inflationary periods, I’d like to note work by Jim O’Shaughnessy back in 2011, in his looking at data over the past 111 years. In the 20 years categorized as high inflation, which averaged almost 6.5% annually, the average real return of stocks was a positive 2.5% compared to bonds at a negative 2.8%. Perhaps surprising to many investors is that stocks were actually positive during these periods. While the Consumer price index most recently rose 6.2% over the last 12 months, it’s worth noting that we’ve been dealing in a unique pandemic period with historical policy and it’s unlikely, in our opinion, for these type of high numbers to persist in a sustainable way.

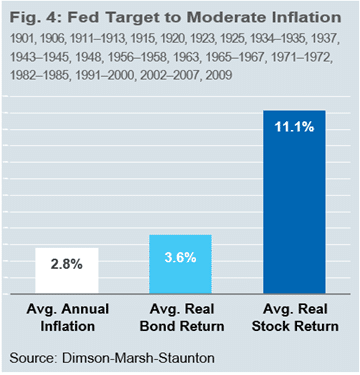

If we shift our attention to the second graph, categorized as Fed Target to Moderate Inflation, we have a larger sample set of 46 years with an average annual inflation rate of 2.8%. This is a number more closely aligned with longer term expectations in our opinion due to economic structural and secular forces likely to keep a lid on persistently high inflation. In looking at this data, not only have bonds experienced positive real returns of roughly 3.6% on average, but stocks have reached double digit returns on average during these periods.

While the inflationary headline risk on a day to day or week to week basis can cause some uncertainty, it’s important to keep the long-view in mind in recognizing that equities have historically done well in various inflationary regimes.

At Krilogy, our portfolio construction process aligns with an investor’s ability and willingness to take risk along with the uniqueness of each customized financial plan.